Think About Your Dream House

Family planning is a huge issue when you’re ready to buy a home. You have to think about the size of your family because you don’t want to have to upgrade in a few years, sell your current home, and start the process over again. Do you plan to stay child-free or do you dream of a house full of children? Maybe two or three is your perfect number. Whatever the case, budget for bedrooms, bathrooms, and the perfect amount of space. You likely have some necessities as well. What’s most important to you? Are you flexible on location, or are you determined to stay in, say, Tampa or Naples? Do you want a home in the city or a house surrounded by greenery? Think about both the luxuries and the essentials, such as:

The number of floors The number of bathrooms and bedrooms A large yard A ranch vs. a colonial And the overall age of the home

Examine the Employment Situation

If you don’t have steady employment, you may want to think twice about buying a house. You don’t want to get stuck with a mortgage that you can’t pay. If your job is on the fence or you’re constantly changing careers, you might need to wait. Likewise, you should decide if both of you need to work. A single-income family situation might not work for the house of your dreams, even if your desires are flexible.

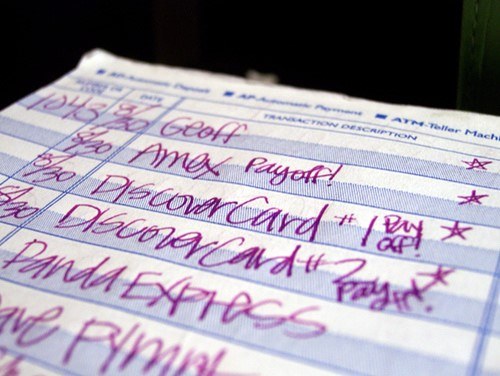

Get a Handle on Your Debts

Your debts weigh heavily on your credit score. Are you in default on any of your school loans? Is there a credit card you’ve neglected to pay off that’s now coming back to haunt you? Before you even go see the bank or any lenders, check out your credit score. To determine your credit score, several aspects factor in:

Your payment history The amount you owe The length of your credit history Any new credit The types of credit

Don’t start opening credit accounts all over the place to boost your FICO score either. That will look even worse, and it will affect your mortgage rate. To get a good mortgage rate, you need a high credit score. At some lending offices, a credit score between 625 and 650 will get you a decent rate. If you want better options for financing and enviable interest rates, you need a score of 700, at least. If you fear your FICO score doesn’t pass muster, all hope isn’t lost. Start paying off your debts now. Use the snowball method if you have to, and pay off the card with the highest interest rate first, then work your way down the list.

Work Out Your Mortgage Management

The housing marketing is always on the rise and fall. Buying a home is a great idea now, because the housing industry is hot. Houses are being sold at lower rates for numerous reasons. That can work very well with your chances for an affordable mortgage rate through www.foundationmortgage.net. You can talk to someone at your local bank or other financial institution to see about your options. If the rates you’re quoted scare you, just remember this: having a mortgage is the same thing as paying rent, except you’re paying yourself to own your home. Your mortgage and interest rates create equity, which you can borrow from in times of trouble and write-off as a tax deduction. Be careful when doing this, you don’t want to borrow more than you can afford. There are 10.2 percent more single-family homes for sale in Florida than there were last year. That increases your chances of finding your dream home, but it will also help you get a better mortgage rate. The law of supply and demand that made good rates so hard to come by during the housing crisis is finally starting to calm down. You simply have to work out what kind of mortgage works for you:

A fixed-interest mortgage, which keeps your interest the same for life An adjustable-rate mortgage, where the rate changes every year Or an interest-only loan, which helps if you need a low payment in the beginning

Stay Within Your Budget

That being said, you still need to stay within your budget. Moving is a big deal anyway; just the cost of moving from a rental to a home you own will cost a bundle, especially if you need new furniture. Plan to spend anywhere between $5,000-$10,000, depending on where you’re going, what you own, and what you can do yourself. You can’t forget about broker’s fees, closing fees, and deposits, either, especially since the average cost of a home in Florida is up to $194,000.

Research Your Loan Options

Whether you’re going for a Tampa mortgage, a Naples mortgage, or a straight Florida refinance plan, there are lots of loan options available to you. For instance, FHA loans come from the Federal Housing Administration, which backs you on insurance as long as you meet the qualifications. VA loans are available to active members of the military as well as eligible veterans. There are also loans from the government and housing offices in your local area, especially for people buying a home for the first time.

Think Outside the Traditional Box

If you’re thinking about an FHA loan, then realize that various HUD homes through the Department of Housing and Urban Development might become available to you. You have to meet strict qualifications, but they’re worth looking into if you’re having trouble getting a loan. You can even think about looking at foreclosed homes in your area, which may cost much less than other homes. Buying a home for the first time is scary but it’s also exciting; it’s one of the best investments you’ll ever make. Are you ready to take the plunge?