This is where You Need a Budget (YNAB) helps by providing you with software that assists you in managing your budget. Plus, unlike Mint, it supports more than just the US and Canada, and not only that, YNAB teaches you a 4-rule method to manage your money with the goal of saving enough so that you can live off the previous months savings without spending any of this month’s income. Here’s the 4-step rule:

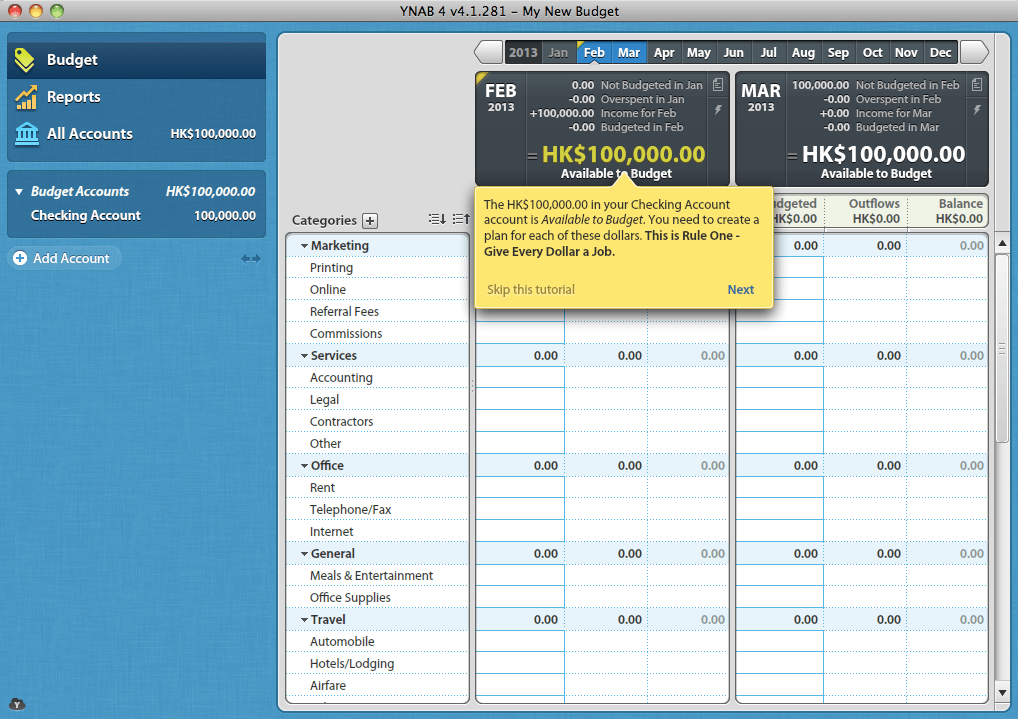

1. Give Every Dollar a Job

The principal behind this rule is to assign your money to an expense, whether that is rent, groceries, etc. So after you add a checking account and put in a total, you need to assign your money to do a job. Any money not assigned can be rolled forward to future months.

2. Save For a Rainy Day

This rule is all about planning ahead. For example, you have home insurance to pay for and it’s due in 6 months. Budget for it across 6 months, so that you don’t spend money impulsively. You can use this rule to save up for vacations and other high ticket items (a new couch or TV). The same method can be used to set aside money for unexpected bills, such as car or home repairs.

3. Roll With the Punches

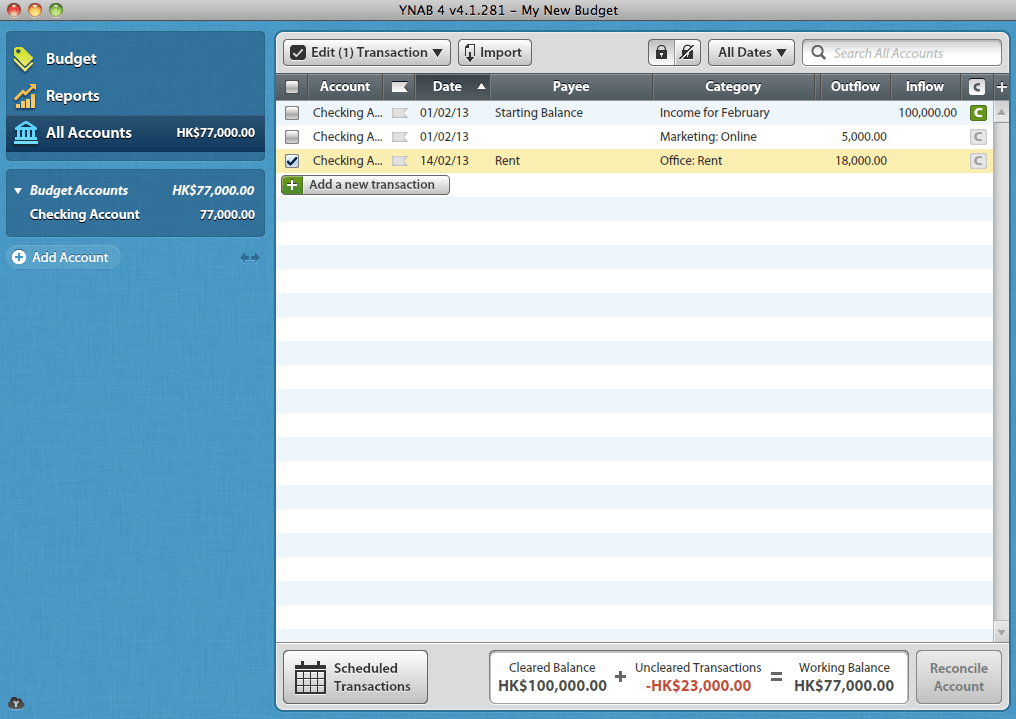

This rule is all about adjusting your budget when you overspend in one category. This happens sometimes; for example, you spend more on books than you intended, in which case, you can adjust your budget by moving some of the money budgeted towards clothes, or have it deducted from next month’s budget so you spend less on books in the following month. It’s straight forward to put what you are spending by adding a new transaction. This can be income or expenditure, and the main budget sheet will keep track of it for you.

4. Live on Last Month’s Income

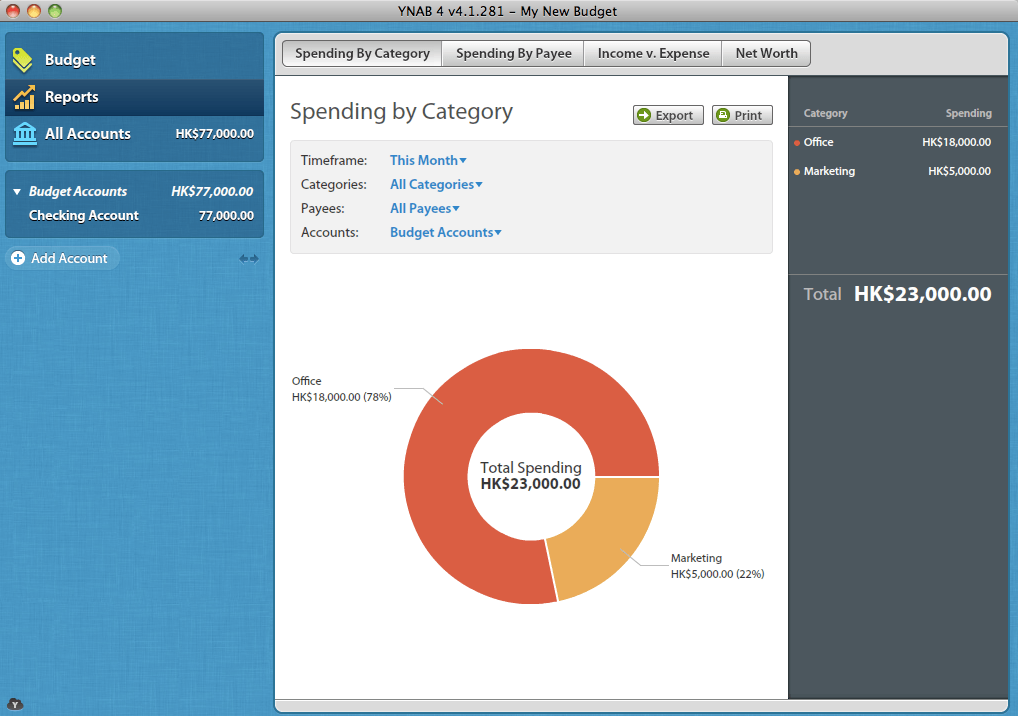

This is the main aim of this method. To save up a month’s worth of paychecks before the month has started. One of the useful features in YNAB are the charts that let you see where the bulk of your money goes. This can help you to re-budget and see which areas of your life takes up most of your income. You these reports to help you re-adjust your budget if necessary or to create targets. For example, if food expenses eat up a large percentage of your spending, you can try and adjust it to make it more proportional to the other parts of your life.

If you follow this method that YNAB coaches, then it can be a useful personal finance (or small business) budgeting tool. It’s free to try for the first 30 days, and if it’s for you, then it only costs $60 to get a license for the software. YNAB also provides a bunch of home study guides and online classes to help you learn and this method.